Fall’s Onset Makes For A Strange Year In Real Estate for Staten Island

Sales down, listings up, yet prices still crack $600k. What gives?

Now that September’s numbers are in, we begin to paint a rather unusual picture of real estate here in the fifth borough. But what else is new?

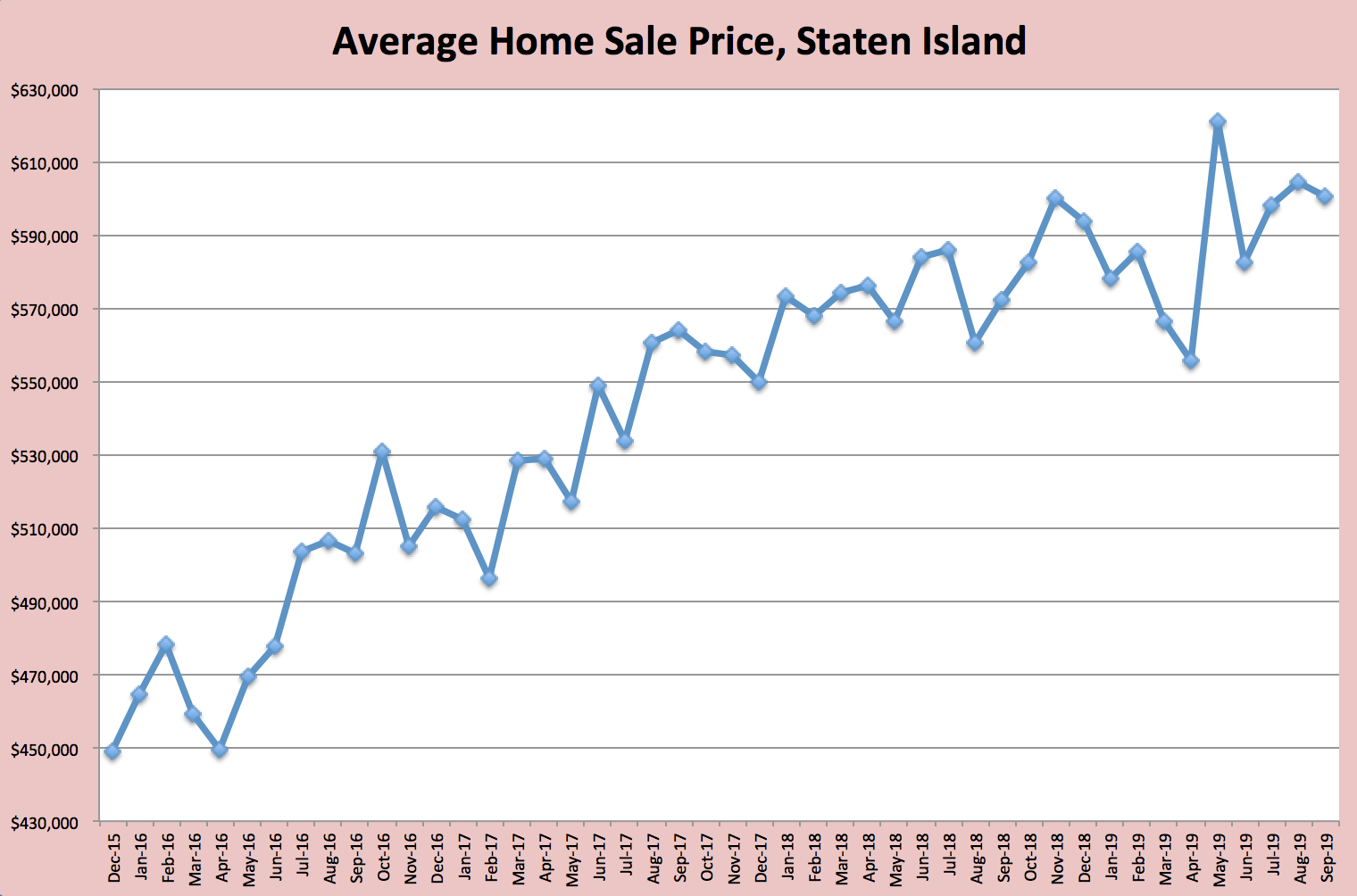

As the months unfold in such dramatic fashion, nothing should surprise us anymore. Homes cost around $400,000 just five years ago, now up 50% to $600,749. For those who don’t venture outside of the metro area, this is not normal. Home prices nationally have risen only 15% on average during the same time, from about $325k to $375k.

And yet… prices have hit another plateau after recovering. And more importantly than that, our leading indicators still point to slowing down.

Staten Island’s home sale prices slid down to $552,054 back in April after hitting the ironic peak of $599,999 last November. Since interest rates have fallen from their 2018 average of 4.71% down to 3.65%, prices bounced back again since home loans became more affordable. They have since flattened out over the last three months.

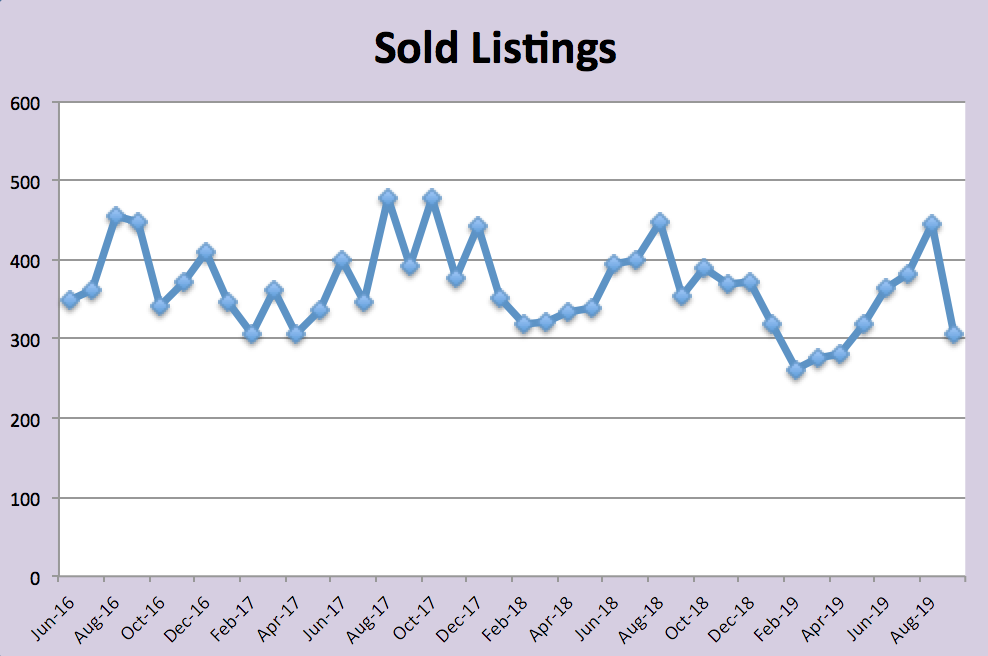

Here’s the key takeaways though: home sales are down and listings are up. September had a teeny sample size of just 306 homes sold on the entire island. That in itself skews price data, but it’s also down 48 total homes from one year ago. Active listings are now up to 2,300 from 2,106 last September.

Homes are also taking longer to sell. Cumulative days on the market is now up to 90 from 78 one year ago. Month’s inventory (or the amount of time needed to sell all the new homes up for sale this month) was up to a staggering 7.52. Six months is around the turning point for a buyer’s/seller’s market. All of these indicators point to a market slowdown.

Inspections: Domestic Buyers Vs. Global Investors

The home inspection is now a central part of buying homes in New York. You can thank the mortgage industry for that.

Over the past few years, New York City had an unprecedented spike in global investments. These were cash buyers who naturally had no use for mortgages at all. Mortgage brokers were losing their buyer pools as home prices rose.

With sale prices now at $600k, most buyers must put down less than 20%- that amounts to $120,000! With a strict 3% FHA loan, home inspections are necessary to obtain a mortgage. And with mortgage rates being lower, you can count on more home seekers applying for them.

Inspections were not nearly as important during the cash buyer influx. Cash buyers have the funds already, making them low risk with fewer hoops to jump through. Realtors should keep this in mind and be prepared to navigate the home inspection process for their clients.